capital gains tax uk

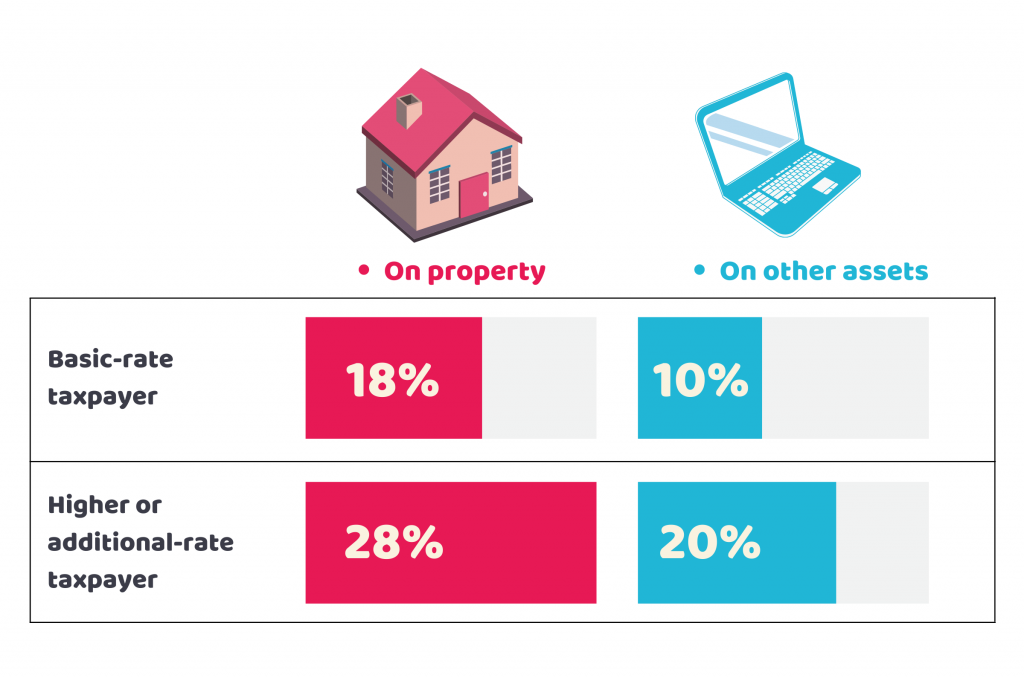

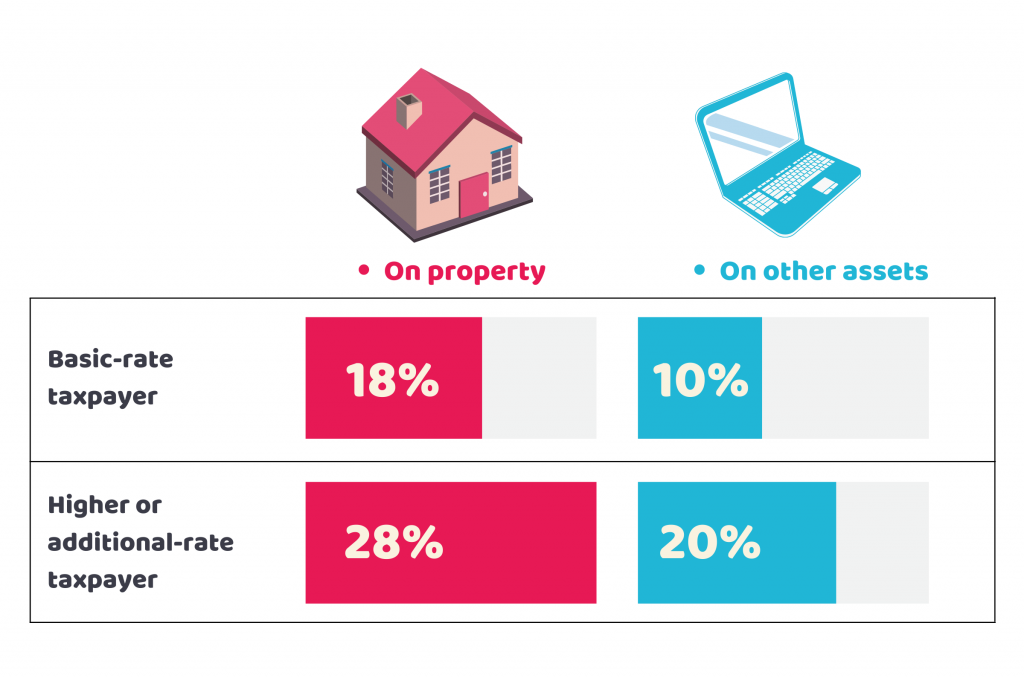

Capital gains tax rates on property UK are 18 for basic rate taxpayers and 28 for high rate taxpayers. However the capital gains tax rate on shares are 10 for basic rate.

Capital Gains Tax Commentary Gov Uk

Capital Gains Tax rates in the UK for 202223.

. Individuals with incomes of more than 450000 554000 for married couples filing jointly are subject to a 25 net capital gains tax rate. The CGT allowance for one tax year in the UK is currently 12300 for an individual and double. Tell HMRC about Capital Gains Tax on UK.

Refer to the HMRC website to find out the CGT allowances for previous tax years. Tax when you sell your home. For any residential property disposed on or after 27 October 2021 the reporting.

The CGT allowance for the 202122 and 202021 tax years is 12300. Capital gains tax rates for 2022-23 and 2021-22. If you have an income of more than.

The capital gains tax rate on shares is 10 for basic rate taxpayers and. If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax. A 10 tax rate on your entire capital gain if your total annual income is less than 50270.

You earn 227700 in taxable gains after any deductible expenses and the CGT allowance. As a US citizen or Green Card Holder receiving dividends in the UK is a unique situation. The amount of tax you need to pay depends on the amount of profit you make when you sell shares.

10 18 for residential property for your entire capital gain if your overall annual income is below 50270. There is a capital gains tax allowance that for 2020-21 is 12300 an increase from 12000 in 2019. 6 April 2010 to 5 April 2011.

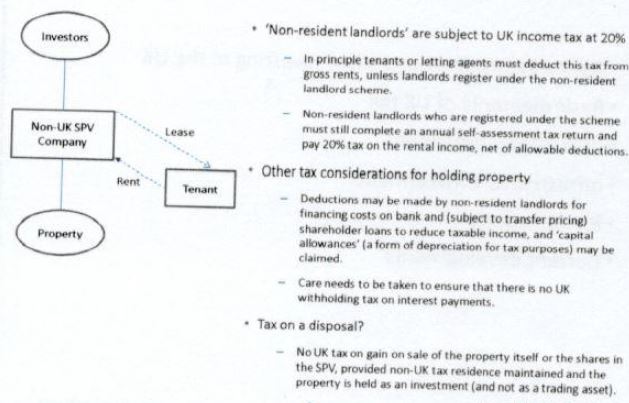

You sell a buy-to-let flat for 250000 which you originally bought for 150000. 20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property from 6 April 2015. Capital Gains Tax CGT usually applies to taxpayers who live in the UK but special rules bring expats and other non-residents into the tax net if they make a profit from.

100000 12300 allowance 87700 taxable. Prior to this capital gains were not taxed. Your entire capital gain will be taxed at a rate of 20 or 28 in the case of the residential property.

This is the amount of. The capital gains tax CGT system was introduced by Labour Chancellor James Callaghan in 1965. Offshore investors are required to pay UK Capital Gains Tax when they dispose of their property.

Channon observed that one of the primary. Tax when you sell property. Based on your salary only youre a basic rate tax.

Your annual salary is. A capital gains tax CGT is the tax on profits realized on the sale of a non-inventory asset. Work out tax relief when you sell your home.

250000 150000 100000 profit. Tax if you live abroad and sell your UK home.

The Definitive Guide To Uk Crypto Taxes 2022 Coinledger

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

Capital Gains Tax Receipts Uk 2022 Statista

How To Avoiding Capital Gains Tax On Property Uk Accotax

Tax Planning For Uk Investments Capital Gains Tax Htj Tax

Uk Gov T Unveils Cryptocurrency Tax Guidelines For Individuals Bitcoinist Com

How To Avoiding Capital Gains Tax On Property Uk Accotax

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Tapestry Alert Uk Capital Gains Tax To Be Reviewed Tapestry Global Legal Compliance Partners

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Private Residence Relief Capital Gains Tax Bdo

Cryptocurrency Taxation In The United Kingdom By Chandan Lodha Cointracker Medium

Capital Gains Tax Help Trading 212 Community

Capital Gains Tax The Advantages Of Taking The Allowance Into Consideration Novia Iq

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Ultimate Guide To Capital Gains Tax Rates In The Uk